Larry's 2013 Tax Guide for U.S. Expats & Green Card Holders in User-Friendly English скачать fb2

Фрагмент книги

1

скачали

0

прочитали

0

впечатлений

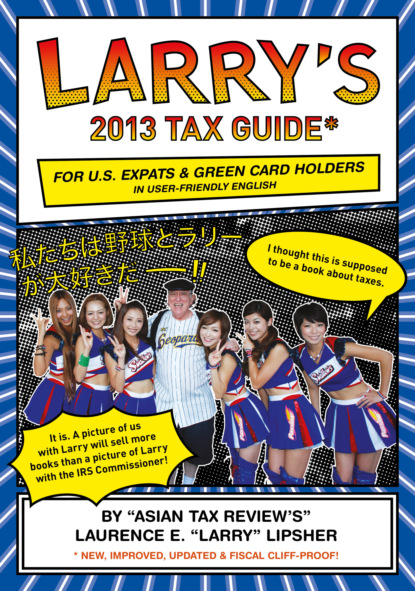

Laurence E. 'Larry' - Larry's 2013 Tax Guide for U.S. Expats & Green Card Holders in User-Friendly English краткое содержание

A guide for the overseas American tax filer, written especially for people who hate taxes.

Читать книгу онлайн Larry's 2013 Tax Guide for U.S. Expats & Green Card Holders in User-Friendly English - автор Laurence E. 'Larry' или скачать бесплатно и без регистрации в формате fb2. Роман написан в году, в жанре . Читаемые, полные версии книг, без сокращений, на сайте - библиотека бесплатных книг Knigism.online. Вы можете скачать издание полностью и открыть в любой читалке, на свой телефон или айфон, а также читать произведение без интернета.

Скачать книгу «Larry's 2013 Tax Guide for U.S. Expats & Green Card Holders in User-Friendly English» Laurence E. 'Larry'

Чтобы оставить свою оценку и/или комментарий, Вам нужно войти под своей учетной записью или зарегистрироваться